Elon Musk's proposal to integrate blockchain technology into treasury operations has sparked significant debate and criticism within the financial and tech communities. As one of the most influential figures in modern technology, Musk's ideas often capture global attention. His recent proposal to use blockchain for treasury management is no exception. While the idea offers potential benefits, it also raises critical questions about its feasibility, security, and regulatory implications.

This article delves into the details of Musk's blockchain treasury proposal, examining the criticisms it has received, its potential impact on financial systems, and the broader implications for blockchain adoption. We will explore both the advantages and challenges associated with this ambitious initiative.

By the end of this analysis, readers will gain a comprehensive understanding of the proposal, its critics' arguments, and the potential future of blockchain in treasury management. Whether you're a tech enthusiast, a financial professional, or simply curious about the intersection of blockchain and finance, this article is for you.

Read also:Mena Suvari A Comprehensive Look At The Renowned Actresss Career And Life

Table of Contents

- Overview of Musk's Blockchain Treasury Proposal

- Elon Musk: A Brief Biography

- Technical Details of the Proposal

- Key Criticisms of the Proposal

- Regulatory Challenges and Concerns

- Potential Benefits of Blockchain in Treasury Management

- Security and Privacy Considerations

- Current State of Blockchain Adoption in Finance

- Comparison with Traditional Systems

- Future Perspective and Implications

Overview of Musk's Blockchain Treasury Proposal

Elon Musk's blockchain treasury proposal aims to revolutionize how governments and corporations manage their financial reserves. The concept involves leveraging blockchain technology to create a transparent, decentralized, and secure system for treasury operations. This approach seeks to address inefficiencies in current systems, such as slow transaction times, high costs, and lack of transparency.

Blockchain technology, known for its use in cryptocurrencies like Bitcoin and Ethereum, offers a unique set of features that could enhance treasury management. These include immutability, decentralization, and the ability to facilitate smart contracts. However, the proposal has faced significant scrutiny from experts and stakeholders who question its practicality and potential risks.

Objectives of the Proposal

The primary objectives of Musk's proposal include:

- Improving transparency in financial transactions

- Reducing costs associated with traditional banking systems

- Enhancing security through cryptographic protocols

- Facilitating faster and more efficient cross-border transactions

Elon Musk: A Brief Biography

Elon Musk, born on June 28, 1971, in Pretoria, South Africa, is a renowned entrepreneur, inventor, and CEO of companies like SpaceX, Tesla, and Neuralink. His visionary approach to technology has earned him a reputation as one of the most innovative leaders of our time.

Biographical Data

| Attribute | Details |

|---|---|

| Full Name | Elon Reeve Musk |

| Date of Birth | June 28, 1971 |

| Place of Birth | Pretoria, South Africa |

| Education | University of Pennsylvania (B.S. in Physics and Economics) |

| Companies Founded | SpaceX, Tesla, Neuralink, The Boring Company |

Technical Details of the Proposal

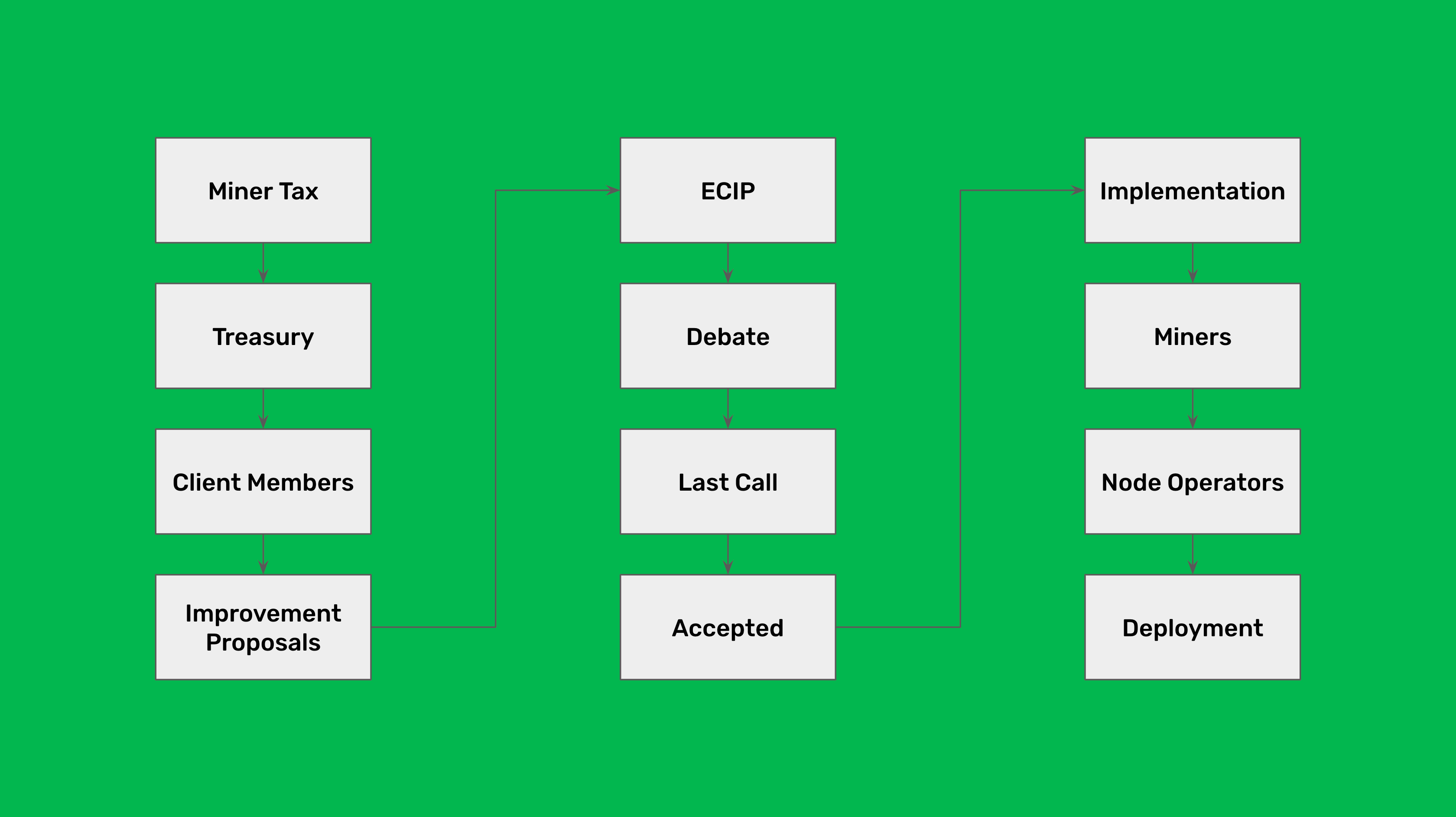

Musk's blockchain treasury proposal outlines a system where blockchain serves as the backbone for managing financial reserves. This system would utilize smart contracts to automate processes such as budget allocation, auditing, and compliance. By eliminating intermediaries, the proposal aims to reduce operational costs and increase efficiency.

However, the technical implementation of such a system presents several challenges. For instance, ensuring interoperability with existing financial systems, addressing scalability issues, and maintaining regulatory compliance are significant hurdles that need to be overcome.

Read also:Jessica Simpson Controversy A Comprehensive Look At The Challenges And Growth

Key Criticisms of the Proposal

Despite its potential benefits, Musk's blockchain treasury proposal has faced numerous criticisms from experts and industry leaders. Some of the key criticisms include:

- Complexity: Critics argue that implementing blockchain technology in treasury operations is overly complex and may require significant resources.

- Security Risks: While blockchain is secure by design, the integration of legacy systems with blockchain networks could introduce vulnerabilities.

- Regulatory Uncertainty: The lack of clear regulations governing blockchain technology creates uncertainty for its adoption in critical financial systems.

Detailed Criticism Analysis

One of the primary concerns raised by critics is the complexity of integrating blockchain with existing financial systems. Traditional banking systems are deeply entrenched, and transitioning to a blockchain-based model would require extensive planning and coordination. Additionally, the potential for security breaches during the integration process poses a significant risk.

Regulatory Challenges and Concerns

Regulatory compliance is a critical factor in the adoption of blockchain technology for treasury management. Governments and regulatory bodies worldwide are still grappling with how to regulate blockchain effectively. This uncertainty creates challenges for initiatives like Musk's proposal, as compliance with existing regulations is essential for any financial system.

Furthermore, the global nature of blockchain technology complicates regulatory efforts, as different countries have varying approaches to its governance. Harmonizing these regulations will be a crucial step in enabling widespread adoption of blockchain in treasury operations.

Potential Benefits of Blockchain in Treasury Management

Despite the criticisms, blockchain technology offers several potential benefits for treasury management:

- Transparency: Blockchain's immutable ledger ensures that all transactions are recorded transparently and cannot be altered.

- Efficiency: Automated processes through smart contracts can streamline operations, reducing the need for manual intervention.

- Cost Savings: By eliminating intermediaries, blockchain can significantly reduce transaction costs.

Examples of Successful Blockchain Implementations

Several organizations have successfully implemented blockchain technology in various sectors. For instance, the World Food Programme (WFP) uses blockchain to manage cash transfers to refugees, ensuring transparency and accountability in aid distribution. Similarly, companies like IBM and Maersk have leveraged blockchain for supply chain management, improving efficiency and reducing costs.

Security and Privacy Considerations

Security and privacy are paramount concerns when implementing blockchain technology in treasury management. While blockchain is inherently secure due to its cryptographic protocols, the integration of legacy systems with blockchain networks can introduce vulnerabilities. Additionally, privacy concerns arise when sensitive financial data is stored on a public blockchain.

To address these concerns, hybrid blockchain solutions that combine public and private blockchains can be employed. These solutions offer the benefits of transparency and security while maintaining privacy for sensitive information.

Current State of Blockchain Adoption in Finance

The adoption of blockchain technology in the financial sector is steadily increasing. According to a report by Deloitte, more than 53% of financial institutions are actively exploring blockchain solutions. This growing interest is driven by the potential benefits of blockchain, such as improved efficiency, reduced costs, and enhanced security.

However, widespread adoption is still hindered by challenges such as regulatory uncertainty, technical complexity, and lack of standardization. Overcoming these obstacles will be crucial for the successful integration of blockchain in treasury management.

Comparison with Traditional Systems

When compared to traditional financial systems, blockchain offers several advantages. Traditional systems often suffer from inefficiencies such as slow transaction times, high costs, and lack of transparency. Blockchain addresses these issues by providing faster, cheaper, and more transparent transactions.

However, traditional systems have the advantage of being well-established and widely accepted. Transitioning to blockchain would require significant changes in infrastructure and processes, which may not be feasible for all organizations.

Future Perspective and Implications

The future of blockchain in treasury management depends on overcoming the challenges associated with its implementation. As regulatory frameworks evolve and technological advancements continue, the adoption of blockchain is likely to increase. Musk's proposal, while ambitious, highlights the potential of blockchain to transform financial systems.

For organizations considering blockchain adoption, it is essential to carefully evaluate the benefits and challenges before making a decision. Collaboration with regulators, industry experts, and technology providers will be key to ensuring successful implementation.

Conclusion

Musk's blockchain treasury proposal has sparked significant debate and criticism within the financial and tech communities. While the proposal offers potential benefits such as improved transparency, efficiency, and cost savings, it also raises critical questions about feasibility, security, and regulatory compliance.

In conclusion, the future of blockchain in treasury management depends on addressing these challenges and leveraging the technology's strengths. We encourage readers to share their thoughts and insights in the comments section below. Additionally, feel free to explore other articles on our site for more information on blockchain and its applications.