Buying a home is one of the most significant financial decisions you'll ever make, and understanding current mortgage rates is crucial to securing the best deal for your home loan. Whether you're a first-time homebuyer or looking to refinance, mortgage rates play a pivotal role in determining the total cost of your home over time. This article dives deep into the world of mortgage rates, helping you navigate the complexities and make informed decisions.

From analyzing the factors that influence rates to exploring strategies for locking in favorable terms, we'll cover everything you need to know. Mortgage rates are not just numbers—they're the foundation of your financial commitment to homeownership. By the end of this guide, you'll have the knowledge to confidently approach lenders and negotiate terms that align with your financial goals.

As interest rates fluctuate with economic conditions, staying informed is key. This article will serve as your ultimate resource for understanding how mortgage rates work, why they change, and how you can take advantage of the best rates available in the market.

Read also:Tiktok Coins A Comprehensive Guide To Understanding And Maximizing Their Use

What Are Current Mortgage Rates?

Current mortgage rates refer to the interest rates lenders charge borrowers for home loans. These rates can vary significantly based on factors such as economic conditions, credit scores, loan type, and the overall health of the housing market. Understanding these rates is essential for anyone considering purchasing or refinancing a home.

Mortgage rates are expressed as a percentage and represent the cost of borrowing money over the life of the loan. For instance, a 30-year fixed-rate mortgage with a rate of 6% means that the borrower will pay 6% interest annually on the outstanding loan balance.

Types of Mortgage Rates

- Fixed-Rate Mortgages: These have a consistent interest rate throughout the loan term, providing stability and predictable monthly payments.

- Adjustable-Rate Mortgages (ARMs): These offer lower initial rates but can adjust periodically based on market conditions, making them riskier for long-term planning.

- FHA Loans: Backed by the Federal Housing Administration, these loans often come with lower down payments and flexible credit requirements.

- Veterans Affairs (VA) Loans: Available to eligible military personnel, these loans often come with competitive rates and no down payment requirement.

Factors Influencing Current Mortgage Rates

Mortgage rates are influenced by a variety of factors, both macroeconomic and personal. Understanding these factors can help you anticipate rate movements and plan accordingly.

Economic Indicators

Key economic indicators such as inflation, employment rates, and Federal Reserve policies directly impact mortgage rates. For example, when inflation rises, lenders may increase rates to compensate for the decreased purchasing power of future repayments.

Credit Score

Your credit score is one of the most significant personal factors affecting mortgage rates. Borrowers with higher credit scores typically qualify for lower rates because they are perceived as less risky.

Loan Term and Type

The length of the loan and its type also influence rates. Fixed-rate mortgages often have higher rates than ARMs, but they offer long-term stability. Conversely, shorter loan terms, like 15-year mortgages, usually come with lower rates but higher monthly payments.

Read also:Exploring The World Of Erome Melayu A Comprehensive Guide

How to Find the Best Current Mortgage Rates

Securing the best mortgage rate requires research, preparation, and sometimes negotiation. Here's a step-by-step guide to finding the best rates:

Shop Around

Don't settle for the first offer you receive. Compare rates from multiple lenders, including banks, credit unions, and online mortgage providers. Each lender may offer slightly different terms, so shopping around can save you thousands over the life of the loan.

Improve Your Credit Score

Raising your credit score can significantly improve the rates you qualify for. Pay down debt, pay bills on time, and avoid opening new credit accounts before applying for a mortgage.

Consider Points

Mortgage points, or discount points, allow you to pay an upfront fee in exchange for a lower interest rate. This can be beneficial if you plan to stay in your home for a long time.

The Impact of Current Mortgage Rates on Homeownership

Mortgage rates have a profound impact on the affordability and feasibility of homeownership. Lower rates make buying a home more accessible, while higher rates can price some buyers out of the market.

Monthly Payments

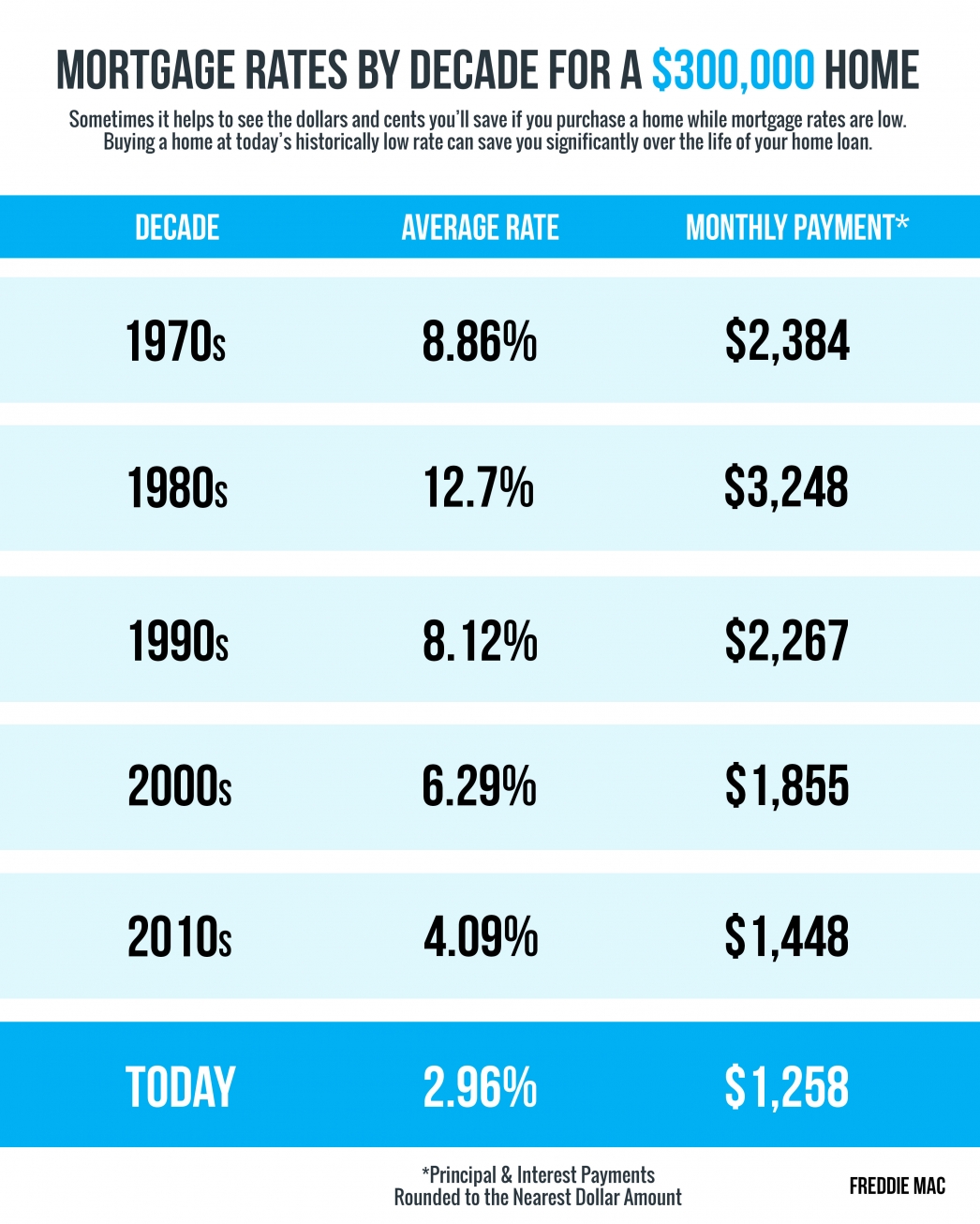

Even a small difference in mortgage rates can result in significant changes to your monthly payments. For example, a 0.5% increase in the rate on a $300,000 mortgage could add hundreds of dollars to your monthly bill.

Total Cost of Ownership

Over the life of the loan, the total cost of ownership is heavily influenced by mortgage rates. A lower rate can save you tens of thousands of dollars in interest payments.

Historical Trends in Mortgage Rates

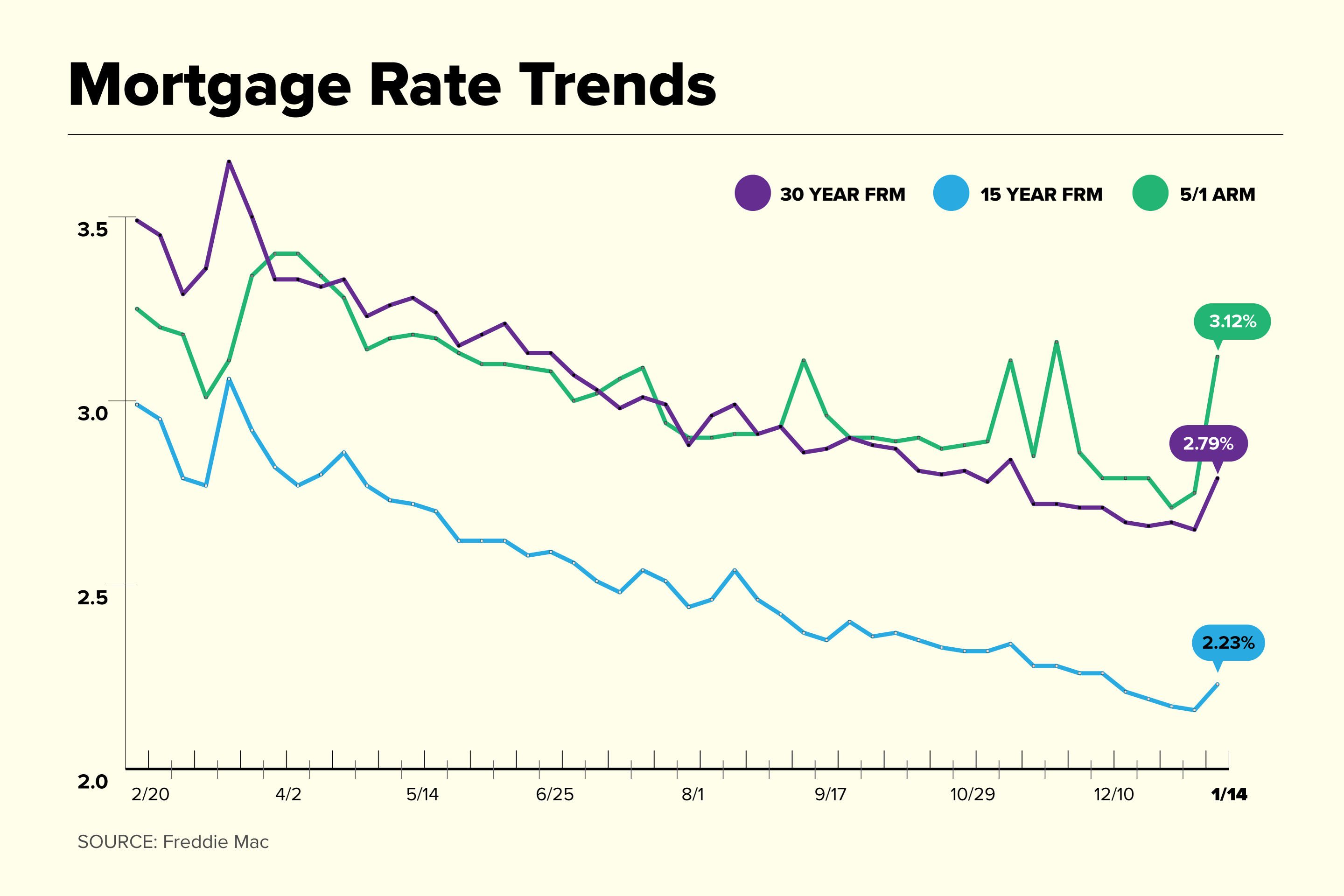

Looking back at historical trends can provide insight into where rates might be headed. Over the past few decades, mortgage rates have experienced significant fluctuations, often reflecting broader economic conditions.

Record-Low Rates

In recent years, mortgage rates hit record lows, driven by Federal Reserve policies aimed at stimulating the economy. This period was particularly favorable for homebuyers and refinancers.

Future Projections

Economists predict that rates may rise as inflation continues to climb and the Federal Reserve tightens monetary policy. However, projections are subject to change based on unforeseen economic events.

Strategies for Locking in Current Mortgage Rates

Once you've found a favorable rate, it's important to lock it in before it changes. Here are some strategies to help you secure the best possible rate:

Rate Lock Options

Many lenders offer rate lock programs that guarantee the current rate for a specified period. This can protect you from rate increases while your loan application is processed.

Timing Your Purchase

Timing your home purchase to coincide with favorable market conditions can help you secure a better rate. For instance, rates may dip during periods of economic uncertainty.

Building a Strong Application

A strong mortgage application demonstrates your financial stability and creditworthiness, increasing your chances of securing a competitive rate. Include documentation of steady income, low debt-to-income ratio, and a solid credit history.

Common Misconceptions About Mortgage Rates

There are several misconceptions about mortgage rates that can mislead borrowers. Here are a few common ones:

Lower Rates Always Mean Better Deals

While lower rates are generally preferable, they don't tell the whole story. Other factors, such as fees and terms, can make a seemingly attractive rate less favorable.

Rates Are Fixed

Many borrowers assume that once a rate is quoted, it won't change. However, rates can fluctuate daily, and locking in a rate is essential to securing the quoted terms.

Refinancing Always Saves Money

Refinancing can reduce your monthly payments, but it may extend the loan term or involve closing costs that offset the savings. Carefully evaluate the pros and cons before refinancing.

How Current Mortgage Rates Affect Refinancing

Refinancing involves replacing your existing mortgage with a new one, often at a lower rate. Current mortgage rates play a critical role in determining whether refinancing makes financial sense.

Break-Even Point

Calculate the break-even point, which is the time it will take for the savings from a lower rate to offset the costs of refinancing. If you plan to stay in your home longer than this period, refinancing could be beneficial.

Cash-Out Refinancing

This option allows you to tap into your home's equity, but it may come with higher rates. Evaluate whether the benefits outweigh the costs before proceeding.

Expert Tips for Navigating Mortgage Rates

Here are some expert tips to help you navigate the complex world of mortgage rates:

- Monitor economic news and Federal Reserve announcements for clues about rate movements.

- Work with a reputable mortgage broker who can negotiate on your behalf.

- Consider both short-term and long-term implications when choosing a loan type.

Conclusion

In conclusion, understanding current mortgage rates is essential for anyone considering homeownership or refinancing. By staying informed about the factors that influence rates, shopping around for the best deals, and employing smart strategies, you can secure favorable terms that align with your financial goals.

We encourage you to share this article with others who may benefit from the information. Leave a comment below if you have questions or additional tips to share. For more insights into personal finance and real estate, explore our other articles on the site.

Table of Contents

- What Are Current Mortgage Rates?

- Factors Influencing Current Mortgage Rates

- How to Find the Best Current Mortgage Rates

- The Impact of Current Mortgage Rates on Homeownership

- Historical Trends in Mortgage Rates

- Strategies for Locking in Current Mortgage Rates

- Common Misconceptions About Mortgage Rates

- How Current Mortgage Rates Affect Refinancing

- Expert Tips for Navigating Mortgage Rates

- Conclusion